Trading Signals

Trading Signals

Blue Indicates Uptrend

Red Indicates Downtrend

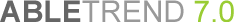

Combines Two Time Frames to Produce a Stronger Signal

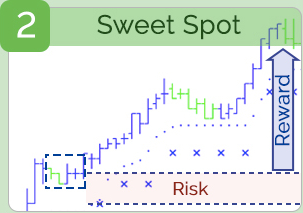

Filters out Choppy Market Trading Signals, which would be Losing Trades

Taken directly from AbleTrend, signals will never change after the fact

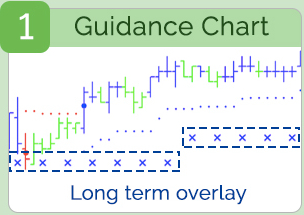

Fresh AbleTrend Sweet Spot Signals by 4pm ET

Please Sign In for The Latest 7 Days Fresh Signals

GOOGL(2/19/26)

INSM(2/19/26)

PLTR(2/18/26)

AMD(2/17/26)

GRMN(2/13/26)

IREN(2/13/26)

OLLI(2/12/26)

QQQI(2/11/26)

AXP(2/10/26)

SLV(2/9/26)

GOOGL(2/9/26)

MU(2/6/26)

MRVL(2/6/26)

AVGO(2/6/26)

BRK.B(2/5/26)

APTV(2/4/26)

GLD(2/3/26)

PLTR(2/2/26)

DELL(2/2/26)

GE(1/30/26)

TSLA(1/30/26)

APP(1/29/26)

VST(1/28/26)

PSLV(1/27/26)

AAPL(1/27/26)

JCI(1/26/26)

MSFT(1/23/26)

META(1/22/26)

MRVL(1/21/26)

IONQ(1/21/26)

ANET(1/20/26)

PNR(1/16/26)

ATO(1/16/26)

AbleTrend Sweet Spot Signals in Progress

JCI (2/25/26)

HUBB (2/24/26)

ASML (2/23/26)

PWR (2/20/26)

GNRC (2/19/26)

TSM (2/18/26)

GE (2/17/26)

TOL (2/13/26)

PWR (2/12/26)

VRT (2/11/26)

IWM (2/10/26)

L (2/9/26)

GLD (2/6/26)

WMT (2/5/26)

STX (2/4/26)

GS (2/3/26)

MU (2/2/26)

GOOGL (1/30/26)

LRCX (1/28/26)

HUBB (1/23/26)

CCJ (1/22/26)

GLD (1/21/26)

CMPO (1/16/26)

AMAT (1/15/26)

ASML (1/14/26)

AMAT (1/12/26)

GS (1/9/26)

LRCX (1/7/26)

CAT (1/6/26)

TRV (12/31/25)

MU (12/29/25)

JPM (12/26/25)

STX (12/11/25)

GS (12/10/25)

TJX (11/21/25)

WELL (11/18/25)

NUVL (11/17/25)

LLY (11/14/25)

GS (11/13/25)

GLD (11/12/25)

14 Reasons Why Investors and Traders Trust AbleSys Signals

1. Stocks and Commodities Magazine Reader's Choice Awards for 29 years in a row

3. Excellent Trust Pilot rating

5. Time-tested Buy On Blue, Sell On Red

7. AbleTrend Support/Resistance (S/R) Dots - Safety Measure in Trading

8. Differentiate Retracement from Reversals with AbleSys Support/Resistance (S/R) Dots

9. AbleTrend was designed to seek profits in volatile markets with managed risk

10. For the cost of one system empowers you to trade all markets

11. Free one-on-one consultation with phone

12. Interactive webinars once a week

13. AbleSys offers a 30-day trial

14. AbleTrend creator, Dr. John Wang, is a Quantum Physical Chemist and active trader