MM is one of the critical elements for successful trading. It may not occur to many traders, but knowing how much money to put into a trade, and how many positions to open, is as important to success as knowing the direction in which a market is moving.

Legendary trader Larry Williams comments on money management this way: "Money Management - The Keys to the Kingdom. Here it is, the most important chapter in this book, the most important chapter in my life, the most valuable thoughts I can transfer from me to you."

MM is not the same thing as "Risk Management". Risk management normally refers to the use of protective stops during a trade. On the other hand, Money Management only deals with "trading size". Here the trading size means the number of shares for stocks, or contracts for futures and foreign currency.

A good, scientific MM strategy can help a winning system to yield much larger profits. However, MM is not a trading system and cannot turn a losing system into a winner. MM does not deal with entry or exit rules (signals). It only calculates the trading size of the next trade based on your current account balance. Therefore, you must first find a winning trading system before applying the MM strategy.

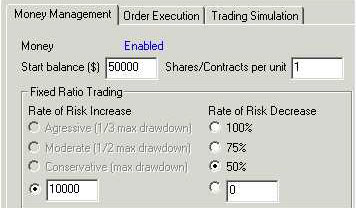

Money Management (MM) is one of the most important issues in trading. MM is not risk management (commonly known as "stops"). MM only deals with trading size - how many contracts or shares to trade while your account balance up or down. Built-in MM routine focuses on Account Management. It could improve the system performance with the same buy/sell signals.

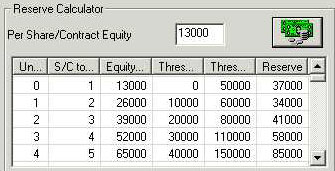

The Cash Reserve Calculator of the MM is used to manage the risk of the trading account.

MM is for yearly or permanent users only. The price is $999/year or $1,999 to purchase.