The Award Winning AbleSys Corporation is proud to introduce its pioneering advanced software – AbleDelta.

AbleDelta is a Module for advanced trading. It's designed specially for spreads, options, and portfolio tradings. It's a collaboration of AbleSys award winning software AbleTrend, and the trading experience of Mr. Robert J. Seifert. Mr. Seifert has been a successful options, stock, and futures trader both on and off the floor of the world's major exchanges for more than 30 years. During those 30 years Mr. Seifert founded and managed two highly successful options floor trading companies. He had input into the design of many options contracts currently being traded at the CME Group, the world's largest futures and options exchange. He conducted trading seminars for the exchange, and lobbied with the CME PAC in Washington. With his help, AbleSys Corporation has been able to transform those winning strategies into one the most user friendly trading, spreading, and options software applications ever brought to market!

AbleDelta is designed to allow advanced traders to perform all types of trades in any liquid market. Using AbleTrend's principal of Universal Price, AbleDelta can initiate and manage the following trades.

The client can use AbleDelta to initiate and manage trades in any liquid market at any recognized exchange in the world. This includes Stocks, Futures, Interest rates, Indexes, ETFs and Currencies. The platform is designed to insure that the client is not entering a trade that has very little chance of success. Once the trade is initiated, the platform will manage the trade, insuring that big winners are never allowed to become losers, and the losers are stopped out. Entry and exit prices are very simple and clear.

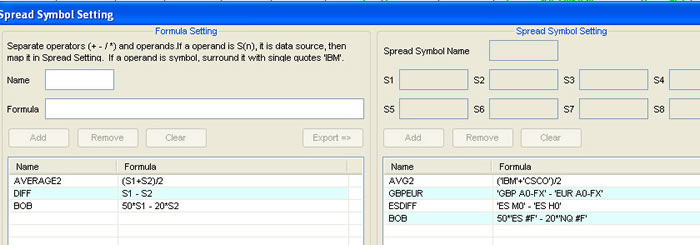

The user can employ AbleDelta to initiate any number of comprehensive strategies for both inter and intra asset spreads. The platform is particularly user friendly in this area. The spreading feature will allow up to eight legs and will produce a single output to manage the complex. AbleDelta has the ability to spread the spread complex. Want to manage your interest rate risk against the stock market or foreign currency risk? Simply put in your individually customized file and AbleDelta will manage the position for you with one simple output graph.

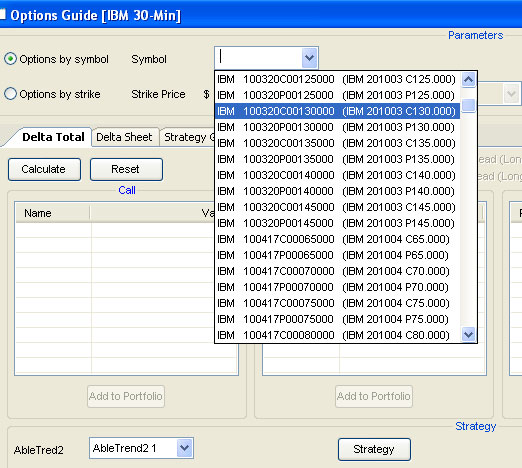

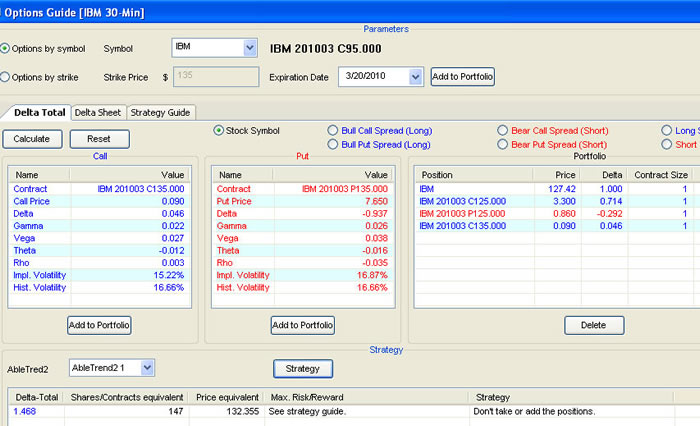

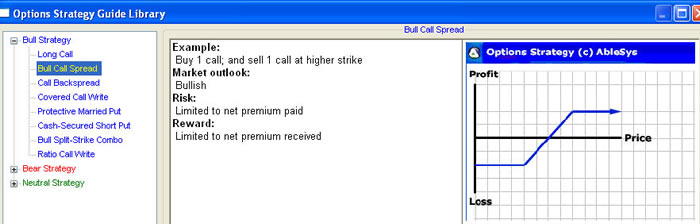

The options portion of the platform is designed to be the most user friendly options product on the market! It has an options library that enables a client to look at the possible outcomes for any single options, or the possible outcomes for a combination of spreads.

IT'S USER FRIENDLY OUTPUT PRODUCES A SINGLE GRAPH and NOT A MATRIX THAT REQUIRES TWENTY DECISIONS.

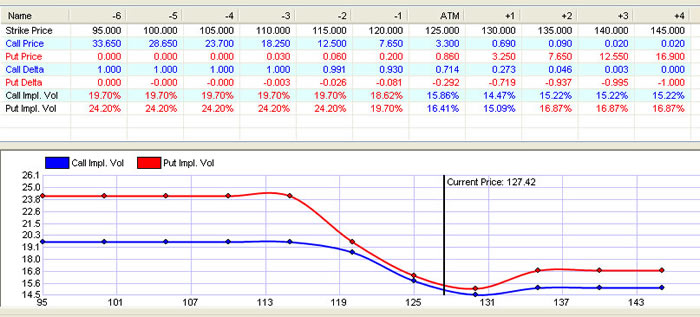

All options strike prices and their Delta's can be plotted to a chart with one click. It will allow you to select which strike should be traded with a glance.

All options prices and their Volatilities with different strike prices can be plotted to a chart with one click. This feature allows the user to employ any strategy with a single key stroke.

20 Options Trading Strategies are built-in the AbleDelta Library for quick references. With one click, you may enter (or add) the options position to the AbleDelta portfolio. This is done automatically with the one click, to select the options, strike prices and expiration date etc.

For more sophisticated investors it supplies all the tools necessary to trade in any market environment. The Wizard internally calculates slope, skew, kurtosis, and it supplies you with the proper strategy to be used under any market condition. With one click, you may enter (or add) the Wizard’s options to the AbleDelta portfolio.

The portfolio management feature allows the client to place up to eight assets in a group and then will produce a SINGLE EQUITY CHART TO MANAGE THE GROUP. It will allow for an unlimited number of assets to be grouped and managed. Able Delta also has the capability to segregate the individual assets and monitor which portion or the portfolio is underperforming, single out the asset that is not producing, and make suggestions how to get the portfolio back to maximum returns.

AbleDelta will be supported not only by Ablesys, but by the AbleDelta Trading Academy. ADTA is a comprehensive course that can be taught on line as well as in live seminars. It not only deals with the navigation of the AbleDelta platform, but also teaches practical trading theories based on the principal or Universal Price for any asset based investment. It places emphasis on user friendly theories that can be managed from a single graph.

AbleDelta Module (ADM) is available with AbleTrend 7.0 as an annual lease, or a full purchase.